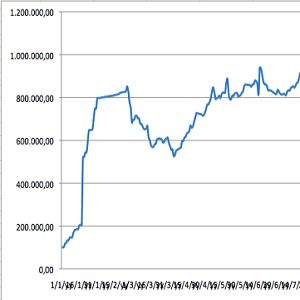

Cash Flow Monitoring

December 29, 2025 - December 29, 2025

Find out the imporance of Cash Flow and download the correct documentation to get you started…

One of the most important things for any business is to make sure you can pay your bills when you need to. Imagine having your production order held up by the manufacturer because you can’t pay for the finished garments, and your customer won’t pay you until the garments have been delivered.

Cash flow problems can be experienced by any size of business but can usually be anticipated so that you can take the necessary action to make sure you don’t run out of cash.

The simplest way of anticipating your cash requirements is to do a cash flow forecast. A spreadsheet such as the template here is a useful tool to use for this.

It is based on the principle that:

Cash at the beginning of the week (or day, or month)

+ Plus money you expect to receive from your customers that week (or day, or month)

– Less payments you need to make to your suppliers that week (or day or month)

= equals cash at the end of the week (or day or month)

During times when you are paying out a lot (e.g. sampling and production times) you may need to look at cash daily. During other times you may need to look at it weekly. During better times you may only need to look at it monthly.

Using the template you can work out what you expect to happen and what might go wrong. Armed with this information in advance you can decide what to do to avoid a problem – for example: make sure your customers pay you on time; don’t spend money on things that you don’t need right now; don’t buy as much of a particular item; etc.

Click here to download the Cash Flow template